Asia Fashion Weekly News Bulletin – ISSUE 39 Week of 3 November 2025

(1) Lululemon built an empire in China — What’s Alo waiting for?

In a market flooded with counterfeits and competitors, Alo’s absence could turn cultural heat into commercial irrelevance.

(2) Luxury recovery? China demand lifts LVMH, Prada

Though many companies still face year-to-date declines, the latest results hint that the global luxury slump may be easing.

(3) Armani Beauty unveils flagship in Mumbai

Armani Beauty has opened a flagship store in the Phoenix Palladium Mall in Mumbai, coinciding with the launch of its first Diwali campaign in India.

(4) Why Stray Kids’ Bang Chan released a song with Fendi

Maison turns its ambassador’s creative vision into a viral, shoppable campaign — and a case study in Gen Z luxury marketing.

(1) Lululemon built an empire in China — What’s Alo waiting for?

(Photo Credit: Jing Daily)

Lululemon’s Q2 fiscal 2025 results highlight its dominant position in China’s athleisure market, with mainland revenue surging 25% year-on-year, making it the brand’s second-largest global market. With 202 stores and over a decade of strategic cultivation, Lululemon contrasts sharply with Alo Yoga, which has no official presence in China despite significant organic buzz from celebrity endorsements and social media visibility.

Alo’s absence has created a vacuum filled by counterfeit products on platforms like Taobao, where knockoffs—ranging from poorly made replicas to entirely fabricated designs—flood the market. Unauthorized resellers and copycat brands (e.g., “Ola” and “Ala”) erode consumer trust and undermine Alo’s premium positioning, with economists warning that prolonged lack of official channels risks irreversible damage to brand integrity and consumer loyalty.

While Lululemon’s success stems from a decade-long, ecosystem-driven approach integrating e-commerce, community engagement, and localized campaigns, Alo’s reliance on organic celebrity-driven hype lacks infrastructure to control narrative or quality. The window for effective entry may be closing, as counterfeit proliferation and Lululemon’s entrenched dominance heighten the challenges for Alo to transition from viral recognition to sustainable market presence.

News Source: https://jingdaily.com/posts/l-oreal-s-kering-acquisition-fuels-its-china-fragrance-ambitions

(2) Luxury recovery? China demand lifts LVMH, Prada

(Photo Credit: Jing Daily)

Europe’s luxury sector shows early signs of emerging from a two-year slump, with LVMH returning to quarterly growth (1% Q3 sales rise) and Kering noting improved trends in China despite a 10% overall sales decline. Mainland China demand turned positive for LVMH with “mid-to-high single-digit” local growth, while Kering observed moderated declines in the region, suggesting cautious optimism for 2025 recovery after prolonged challenges.

Ultra-luxury brands Brunello Cucinelli and Hermès defied industry downturns with strong growth: Cucinelli’s Q3 sales rose 11.8% (15.6% nine-month growth) driven by double-digit gains in China, while Hermès posted 10% Q3 growth and expanded its Asian retail footprint. In contrast, Ferragamo and Zegna struggled with Asia-Pacific declines (-10.5% and -10% Q3 sales respectively), reflecting persistent weak consumer sentiment and regional unevenness.

Prada’s resilience (9% nine-month sales growth, 10% Asia-Pacific rise) positions it for expansion post-Versace acquisition, while Kering’s leadership changes and asset sales signal restructuring amid challenges. Zegna’s store closures in Greater China and pivot toward Tom Ford highlight adaptive strategies, underscoring a broader industry bifurcation where super-luxury thrives mid-market brands face continued headwinds despite glimmers of regional recovery.

News Source: https://jingdaily.com/posts/luxury-recovery-china-demand-lifts-lvmh-prada

(3) Armani Beauty unveils flagship in Mumbai

(Photo Credit: InsideRetail)

Armani Beauty has launched its first flagship store in Mumbai’s Phoenix Palladium Mall, marking the brand’s retail debut in India with the simultaneous rollout of its inaugural Diwali campaign. The store opening coincides with the festival of lights, a strategic move to embed the luxury beauty brand within India’s most vibrant cultural season. Drawing on the symbolic marigold flower central to Diwali celebrations, the mall has been transformed with festive decorations, creating an immersive experience that blends Italian elegance with Indian tradition.

The campaign reflects Armani Beauty’s commitment to cultural relevance and consumer connection beyond transactional retail. “Armani Beauty’s first Diwali campaign in India builds on its vision to be locally and culturally relevant, aiming for experiences beyond commerce for the Indian consumer,” stated Charles-Alexandre Bockzmak, General Manager of L’Oréal International Distribution Sapmena. Biju Kassim, CEO of Global SS Beauty Brands—Armani Beauty’s distribution partner in India—echoed this sentiment, emphasizing the brand’s role in sparking a transformative beauty movement tailored to evolving local trends and preferences.

Operating under a long-term license with L’Oréal, Armani Beauty first announced its flagship store plans in November of the previous year. This Diwali activation, supported by local partnerships, signals a deeper investment in the Indian market, positioning the brand not only as a luxury import but as a participant in the country’s cultural narrative—merging global sophistication with festive authenticity.

News Source: https://insideretail.asia/2025/11/04/armani-beauty-unveils-flagship-in-mumbai/

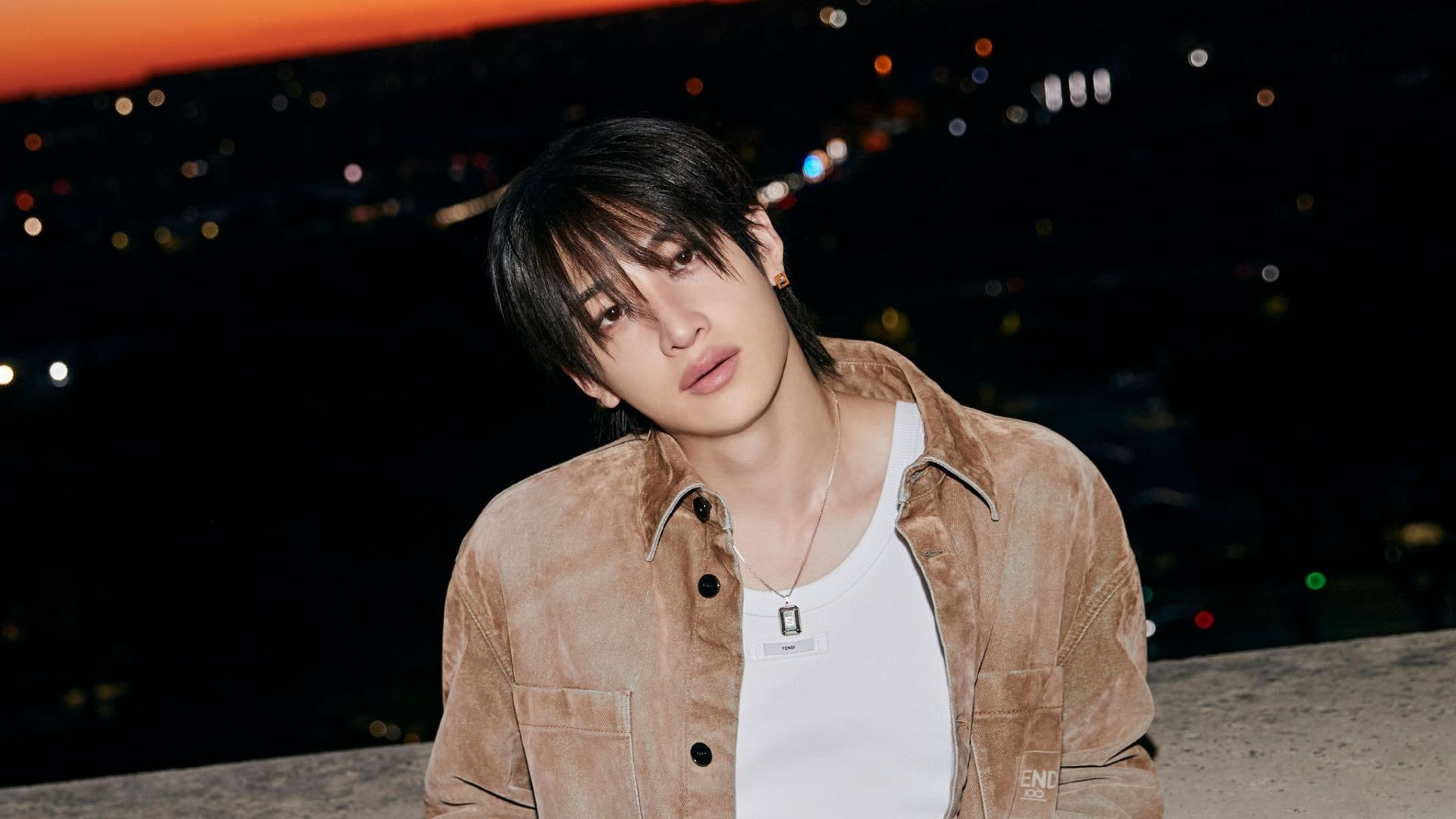

(4) Why Stray Kids’ Bang Chan released a song with Fendi

(Photo Credit: Fendi)

Fendi and Stray Kids’ Bang Chan launched their collaborative single “Roman Empire” on November 3, with every outfit from the music video instantly shoppable via direct links on Fendi’s website. The track, written, composed, and produced by Bang Chan, premiered with screenings on Seoul’s massive K-pop Square LED screen at COEX and was followed by an exclusive live performance at Fendi’s Seoul boutique on November 4. The music video, filmed at Fendi’s Rome headquarters, the Palazzo della Civiltà Italiana, weaves in references to iconic Fendi elements like the Peekaboo bag and “FF” logo, blending smooth R&B with Miami bass beats.

The collaboration has generated significant buzz, with Fendi’s Instagram announcement surpassing 460,000 likes, #BangChan reaching 48.3 million views on Xiaohongshu, and the music video trending on TikTok with over 780,000 views on release day—some featured pieces already selling out. Bang Chan, who joined Fendi as a global ambassador in January 2025 after debuting at the brand’s Milan Men’s Spring/Summer 2025 show in June 2024, shared the project with his 11 million Instagram followers. Fans have embraced the commercial tie-in enthusiastically, undeterred by its overt branding.

Strategically, the release aligns with LVMH’s push to deepen ties with South Korea’s luxury market and Gen Z consumers, a region showing resilience amid global challenges, with LVMH reporting positive Q3 2025 growth driven by Asia. South Korea leads globally in per capita luxury spending at $325 annually, fueled by the MZ generation and amplified through social media virality. By channeling K-pop fandom and delaying streaming platform availability to boost YouTube engagement, Fendi has tapped into a powerful cultural and commercial engine.

News Source: https://jingdaily.com/posts/why-stray-kids-bang-chan-released-a-song-with-fendi