Asia Gaming Weekly News Bulletin – ISSUE 36 Week of 13 October 2025

(1) Gaming tax revenue in Macau up 6% to $8.78B in January–September period

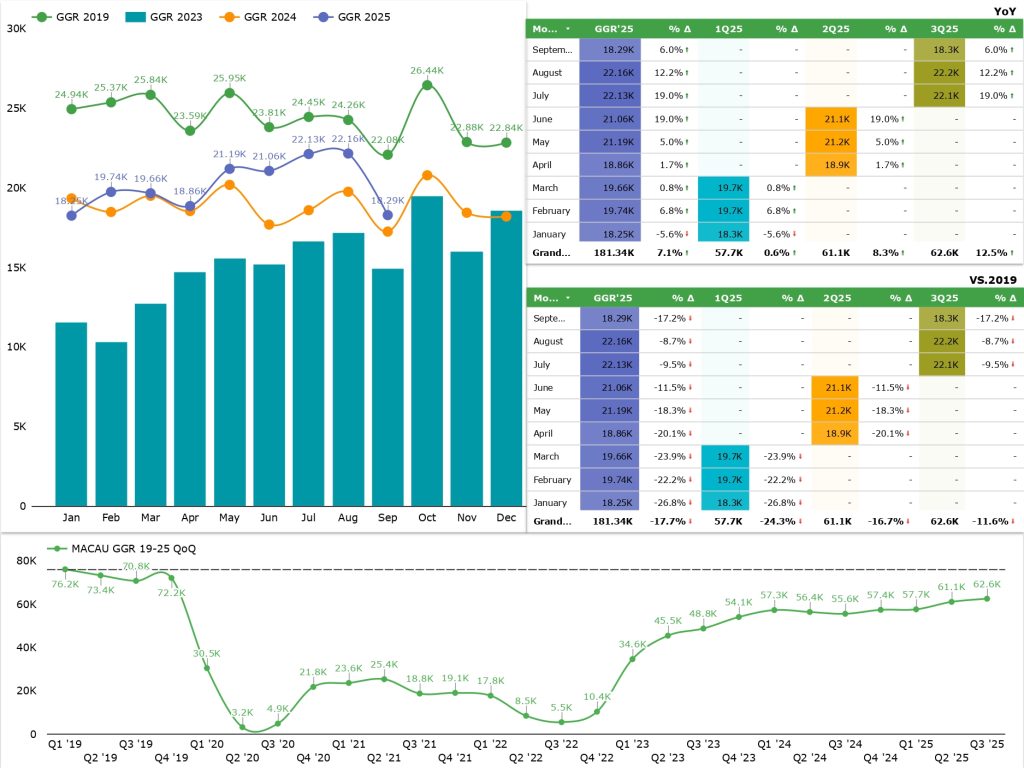

Macau’s 9-month gaming tax revenue hits MOP70.41B, up 6%, driven by 7.1% GGR rise to MOP181.3B. Sector accounts for 85% of fiscal intake, nearing annual targets.

(2) Tom Arasi to join Galaxy Entertainment Group as CFO with Ted Chan to step down

GEG appoints Thomas Arasi as new CFO effective October 27, replacing Ted Chan, who departs November 22 after seven years. Arasi’s 35+ years of expertise bolsters strategic finance leadership.

(3) Macau 3Q casino EBITDA to rise 7% YoY with Wynn gaining most market share: Citigroup

Macau’s casino industry is expected to post a 7 percent year-on-year increase in sector EBITDA for the third quarter of 2025, driven by resilient mass-market demand despite temporary disruptions caused by a September typhoon, according to Citigroup’s latest research report.

(4) Nomura: MGM withdrawal boosts Genting Malaysia’s New York license odds but also raises questions over potential returns

MGM’s exit from New York casino licenses favours Genting Malaysia’s $5.5B Resorts World expansion, but Nomura questions economics amid high fees/taxes and proximity risks; phased rollout offers mitigation and head start.

(1) Gaming tax revenue in Macau up 6% to $8.78B in January–September period

(Photo Credit: Asia Gaming Brief)

Macau’s government has collected MOP70.41 billion ($8.78 billion) in gaming-related fiscal revenue for the first nine months of 2025, a 6% increase year-over-year, per Financial Services Bureau (DSF) data. This uptick mirrors the city’s gross gaming revenue (GGR) of MOP181.3 billion ($22.58 billion) from January to September, up 7.1% from 2024. August saw MOP8.53 billion ($1.06 billion) in gaming taxes, signaling sustained recovery in the post-pandemic casino sector under the 10-year concession framework effective since January 2023, with a 40% tax rate on GGR.

September’s GGR dipped to $2.27 billion following August’s peak, yet the overall trend supports the industry’s resilience. Earlier in 2025, authorities adjusted the full-year GGR forecast downward by 5% to MOP228 billion ($28.37 billion), projecting gaming tax revenue at MOP88.56 billion ($11.02 billion). These figures highlight gaming’s pivotal role in Macau’s economy, comprising 85.2% of total current revenue (MOP82.63 billion or $10.27 billion) as of September 30, with collections reaching 79.5% of the annual tax target.

This performance underscores Macau’s heavy fiscal dependence on gaming, with implications for regulatory stability and economic diversification efforts. As the sector nears year-end targets, stakeholders monitor potential adjustments to concessions and tourism policies to bolster long-term growth amid global uncertainties.

News Source: https://agbrief.com/news/macau/13/10/2025/gaming-tax-revenue-in-macau-rises-6-to-8-78b-in-january-september-period/

(2) Tom Arasi to join Galaxy Entertainment Group as CFO with Ted Chan to step down

(Photo Credit: Inside Asian Gaming)

Galaxy Entertainment Group (GEG) announced on October 14, 2025, the appointment of Thomas Arasi, former President and Chief Operating Officer of Bloomberry Resorts Corp (operator of Solaire), as its new Chief Financial Officer. Arasi, bringing over 35 years of experience in financial services, hospitality, and integrated resorts, including 16 years in the sector, will assume the role on October 27, 2025. His multicultural expertise spans operations in North America, Japan, Singapore, and the Philippines, positioning him to strengthen GEG’s finance operations amid strategic growth in the competitive Macau gaming industry.

Arasi replaces Ted Chan, who will step down and leave the company on November 22, 2025, to pursue personal interests. Chan, who joined GEG in 2018 as COO for Japan Development and became CFO in March 2023, contributed significantly to finance operations, corporate finance, investor relations, and establishing GEG’s market leadership. GEG Chairman Francis Lui praised Chan’s seven-year tenure, noting his role in the Japan project through 2022 and overall leadership, while expressing confidence in Arasi’s seamless transition with Chan’s support.

Lui highlighted Arasi’s potential to maintain a robust finance function, emphasizing his industry acumen and global sensitivity. Chan expressed gratitude for his enriching experience at GEG, crediting the Chairman’s guidance and talented colleagues. This leadership change occurs as Macau’s gaming sector shows recovery, with GEG’s properties like Galaxy Macau driving revenue growth, underscoring the importance of financial stability for regulatory compliance and expansion.

News Source: https://asgam.com/2025/10/14/tom-arasi-to-join-galaxy-entertainment-group-as-cfo-with-ted-chan-to-step-down/

(3) Macau 3Q casino EBITDA to rise 7% YoY with Wynn gaining most market share: Citigroup

(Photo Credit: Asia Gaming Brief)

Analysts George Choi and Timothy Chau from Citigroup forecast Macau’s gaming industry EBITDA at $2.07 billion for Q3 2025, with gross gaming revenue (GGR) rising 12.5% year-on-year to MOP62.57 billion ($7.78 billion), the highest quarterly figure since the January 2023 reopening. This robust recovery is driven by record August visitor arrivals and stable mass-market performance, though margins dipped by 80 basis points due to a 33-hour storm-related shutdown causing lost operating hours and extra wage costs. The sector’s resilience highlights ongoing post-pandemic momentum amid favourable tourism trends.

Wynn Macau and Sands China are projected as the leading market-share gainers among the six concessionaires. Wynn’s share is expected to increase from 11.9% in Q2 2025 to 13.7% in Q3, fuelled by normalized mass hold rates and a strong VIP win rate, boosting property EBITDA 17% year-on-year to $306 million—the sector’s top growth. Sands China’s share rises from 22.8% to 23.7%, aided by its new player reinvestment strategy, though EBITDA growth is muted at 1% due to unfavourable VIP holds. In contrast, MGM China and Melco Resorts & Entertainment see shares decline by 1 and 0.9 points to 15.6% and 14.6%, respectively; MGM’s EBITDA is still set to grow 13% to $290 million, maintaining a 27% margin.

The Macau gaming sector trades at 8.5 times FY2026 EBITDA, 1.5 standard deviations below its historical average of 11.6 times, signalling undervaluation. Citigroup upholds ‘Buy’ ratings on most operators, favouring Galaxy Entertainment and Sands China for their mass-market diversification and financial stability. Wynn Macau receives an upgrade from Neutral to Buy, driven by catalysts like the Wynn Palace Chairman’s Club expansion in early 2026, with Wynn and MGM China flagged for a 30-day ‘upside catalyst watch’ anticipating superior year-on-year results.

News Source: https://agbrief.com/news/macau/16/10/2025/macau-3q-casino-ebitda-to-rise-7-yoy-with-wynn-gaining-most-market-share-citigroup/

(4) Nomura: MGM withdrawal boosts Genting Malaysia’s New York license odds but also raises questions over potential returns

(Photo Credit: Resorts World New York City)

MGM Resorts’ abrupt withdrawal from the competition for one of three full casino licenses in downstate New York has boosted the prospects of Genting Malaysia’s Resorts World New York City bid, leaving only three remaining candidates—Hard Rock’s Citi Field proposal, Bally’s in the Bronx, and Genting’s expansion of its existing electronic gaming machine (EGM)-only facility. MGM cited concerns over geographic clustering of licenses and a 15-year term shorter than the expected 30 years, prompting the New York Gaming Facility Location Board to potentially award fewer than three licenses. Investment bank Nomura views Genting as a frontrunner due to its comprehensive proposal and operational head start, but flags potential economic risks in the company’s $5.5 billion expansion plan, especially given subpar returns at other Genting properties like Resorts World Catskills and Las Vegas.

Genting’s revised bid, submitted earlier this week, includes aggressive commitments such as a $600 million license fee (exceeding the $500 million minimum) and elevated gaming taxes—56% on slots and 30% on tables—surpassing competitors’ offers and raising questions about project viability. Nomura analyst Tushar Mohata notes these terms, likely drafted before MGM’s exit, could strain returns, compounded by cannibalization risks from Hard Rock’s nearby Metropolitan Park site, just 10 miles away. The shorter license duration and high financial pledges further amplify scrutiny, as they deviate from initial expectations and could impact long-term profitability in a competitive market.

Mitigating factors include Genting’s phased development, enabling Phase 1 completion by July 2026 with 4,000 slots and 250 tables—a four-year advantage over greenfield projects—and better capital management to reduce risks. Additionally, Genting proposes a “level playing field” clause: if a nearby licensee secures lower tax rates, Genting should receive equivalent terms. Nomura anticipates clarity on return on invested capital (ROIC) will take years due to the staged rollout, but maintains a positive outlook on Genting’s positioning, emphasizing its existing infrastructure as a key differentiator in the downstate New York race.

News Source: https://asgam.com/2025/10/15/nomura-mgm-withdrawal-boosts-genting-malaysias-new-york-license-odds-but-also-raises-questions-over-potential-returns/